Energy Markets are Electric!

Casper Bjarnason examines the shift to renewable energy, highlighting challenges, opportunities, and strategic innovations necessary for accelerating our journey towards solving the climate crisis.

It feels like I could have written this article 10 years ago, so why have I waited until now? Because while the problem in the energy sector is not novel, the size of the problem is at an all-time high, and here’s why:

The energy sector is currently responsible for approximately three-quarters of greenhouse gas emissions. The majority of our energy supply has historically come from fossil fuels (burning coal, oil, gas). And since energy powers everything, the production of it is one of the largest emitters of carbon emissions.

In an attempt to reduce emissions — and in our race to reach net zero by 2050 — society has decided to focus our attention on reducing the use of fossil fuels and increasing the energy mix (the primary energy sources and their contribution to the total energy production) to renewable, low carbon alternatives.

We have also decided to electrify everything. By doing so, we believe that we can reduce the number of sectors we need to decarbonize as the decarbonization problem simplifies down to just the problem of decarbonizing our energy production.

So the climate challenge is, first and foremost, an energy mix challenge. This is THE lowest-hanging fruit to solving the climate crisis.

Concurrently, this shift to renewable energy production serves as a massive unlock for new business models and opportunities to build iconic companies.

Distributed Energy Resources (DERs) such as solar, wind, and battery assets, move the grid from a one-directional system — where electricity is produced in massive power plants — into a multi-directional, decentralized energy system.

Our energy generation is moving from centralized power plants to the ubiquity of decentralized renewable energy-producing assets.

_____

If we can shift the energy mix to one with mostly renewable, low-carbon alternatives and successfully electrify all energy consumption, what does the EU energy system look like in 10 years?

In 10 years’ time, the EU energy mix will be comprised of 60+% renewables and will have the energy storage and grid flexibility infrastructure to manage the intermittency of energy generation. The European energy system will be a mix of distributed energy and storage capacity, as well as utility-scale renewable energy generation and storage capacity working in harmony to meet our society's energy demand. Think solar on roofs of commercial buildings, industrial sites, warehouses, farms, and car parks, as well as both on and offshore wind. In addition, there will be batteries everywhere — in commercial buildings, residential properties, industrial sites, and in cars moving around as mobile battery assets.

On top of this, due to electrification, the demand for electricity in the EU will be 20% greater by 2030. But the path to achieving this vision is not that simple. It will require us to coordinate and overcome many challenges to ensure flexible grid infrastructure. To understand the macro trends at play it’s useful to break them down to the supply side (electricity generation) and demand side (electricity consumption).

Grid flexibility refers to the ability of a power system to quickly adjust its electricity supply and demand balance in response to variability, unpredictability, and sudden changes in electricity production and consumption. This includes integrating renewable energy sources, responding to fluctuations in demand, and managing unexpected outages or changes in power flow. Essentially, it's about efficiently managing the grid's dynamics to ensure reliable, stable, and cost-effective electricity delivery.

Supply Side: Electricity Generation

The rise of intermittency from renewable energy poses a risk for grid balancing. The vision of 60% of EU energy capacity being renewable by 2030 is not only a vision it’s the current projection. Renewable’s share of the energy mix will be nearly twice their contribution in 2021.

On a global scale, there is pressure to double the supply of renewable energy production by 2030. With renewables being added to the grid at an all-time high rate, it comes with its drawbacks of intermittent generation. Solar and wind power only produce energy when the sun shines and the wind blows. Consequently, the variability of energy production from solar and wind leads to less certainty around grid capacity planning, and supply shortage risk.

→ Greater volatility of electricity generation

One core aspect that has shifted in the last decade is the reduction in the cost of renewables which has pushed the economic case for renewable energies to a no-brainer, with solar and wind leading the way. From 2009 to 2019, the cost of electricity from solar dropped 89% while the price of electricity from onshore wind dropped 70%, bringing the cost of solar and wind below that of fossil fuels. Now renewable electricity production is both less carbon-intensive and cheaper. Go figure.

Demand side: Electricity Consumption

Society is trying to electrify everything on a mass scale to simplify the energy decarbonization challenge. The ‘electrification of everything’ paradigm means that electricity consumption is rising. If we are trying to electrify everything as a society, from our homes to industry to industrial processes, then our electricity demand is going to rise significantly and, therefore, the grid must deal with higher peak loads.

EV sales are projected to comprise 60% of new car sales by 2030, while global heat pump sales are expected to meet 20% of global heating needs by 2030. Currently, electricity consumption in Europe is expected to rise by 3% annually or 20% by 2030, or approximately 31% by 2050, while the population of the EU is expected to decline by 2050.

→ Significant increase in demand for electricity

Conceptualization of Supply Side (Electricity Generation) and Demand Side (Electricity Consumption) Dynamics:

And as a function of this supply and demand dynamic, electricity prices are becoming extremely volatile. Although we have the recent EU energy crisis of 2022 close in our memory, this doesn't mean that electricity prices will be high forever. However, what is undeniable though is there is extreme uncertainty about electricity prices in the near-term future and the longer-term horizon. Electricity prices could go down due to decreasing costs of renewables and the simultaneous increase of renewables in our grid’s energy mix, however, costs have already dropped 89% and 70%+ for solar and wind over the last 10-15 years, how much further do we expect this to drop? The counterargument could be that due to the rising demand for electricity as we try to 'electrify everything’ maybe prices go up. This is the big crystal ball question. Which of the demand or supply side pressures will outweigh the other? The only thing certain is uncertainty.

The Tailwinds of the European Energy Crisis

In the energy crisis during 2022, the EU experienced supply-side shocks to base load energy sources such as coal, oil & gas (Russia's share of total EU petroleum oil imports dropped from 15.9% in Q2 2022 to 2.7% Q2 2023), as well as hydro and nuclear. Looking forward, this may drive up reliance on EU renewables and lead to a new normal in EU energy markets for the foreseeable future. To improve European energy independence and security, the EU launched the REPowerEU Plan in May 2022 to foster a European energy sector with a lower power sector demand for oil & gas and a greater appetite for the development of low-cost renewables (solar and wind) generated locally in the EU to reduce the reliance on external energy sources in the long term. However, this consequently adds to the volatility challenges inherent to the production of renewable energy.

So back to the question. Why is this happening now and not 10 years ago? Fundamentally the problems are not novel but the size of the problem is at an all-time high. The pressure on companies to decarbonize has never been higher. The electricity market supply has never been more intermittent and volatile. The cost of renewables has never been cheaper. And the price of electricity has never been more uncertain. And voila! The time for energy investing is now.

In the New Nordics, Energy & Climate as a sector already received the most invested capital and # of rounds out of all sectors in 2023 with €195m deployed across 23 preseed - Series A investment rounds. However, I anticipate this will continue in 2023 due to the opportunity timing within energy markets.

So what are we excited about at byFounders?

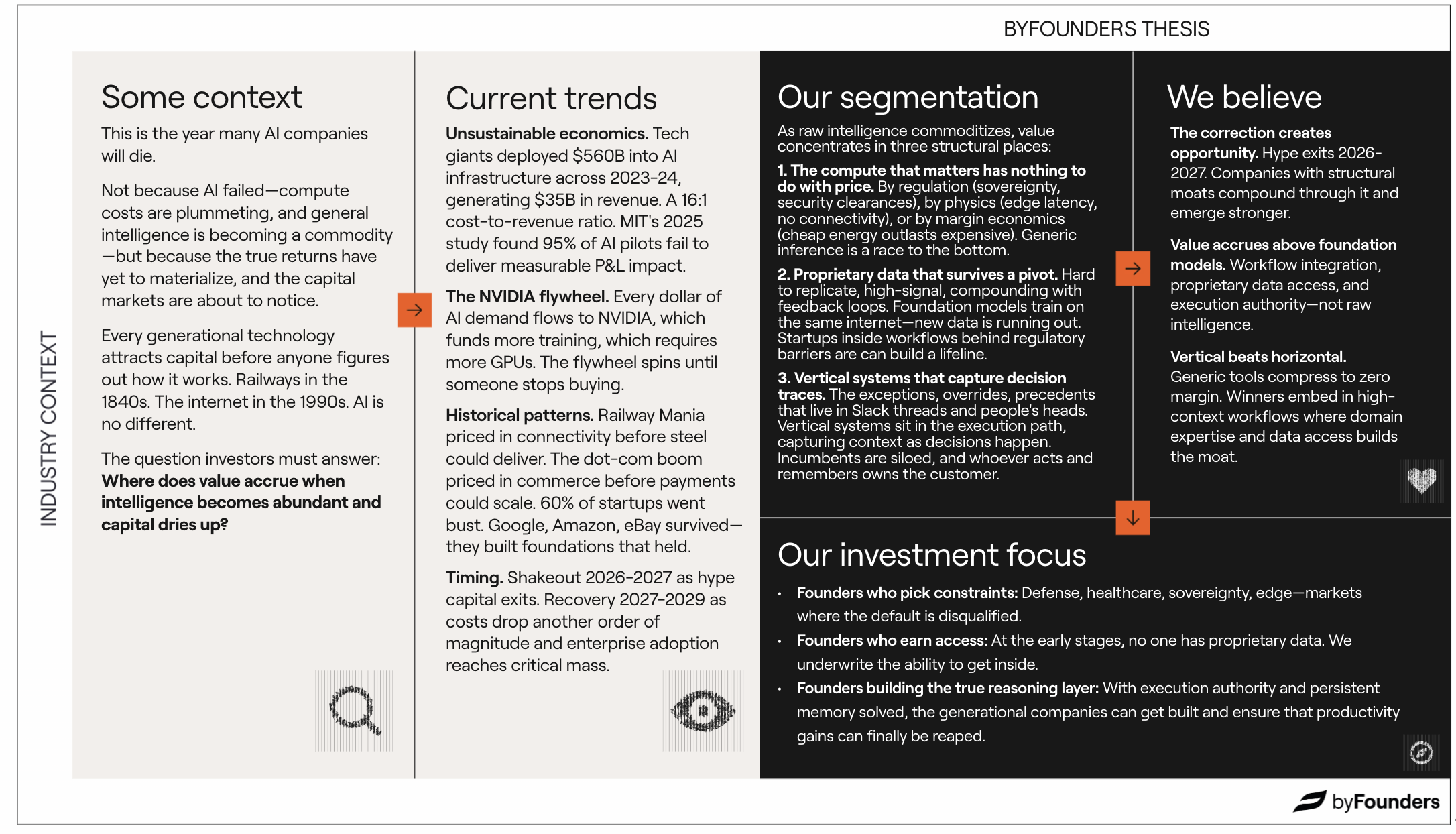

We view the development of startups within the energy sector as occurring in 3 waves. ‘Supply Side: Energy Generation’ has been a focus within energy investing since ~2010s in Europe, 2. ‘Demand Side: Energy Consumption’ which categorizes the wave from 2015 onwards and now 3. ‘Grid Flexibility’ is the current wave of focus within energy investing in early-stage startups.

.png)

Since the inception of byFounders, we have been in the depths of Wave 2 of the electrification of industries. We were able to foresee two of these trends, notably electrifying the built environment and transportation. Within electrifying the built environment we have invested in Ento within commercial buildings, as well as Greenely and DREM within household decarbonisation. And within electrifying transportation, we have been an early supporter of Monta.

Now we are shifting our attention to the opportunities within the third wave — grid flexibility, while also keeping a keen eye on the emerging trends within the electrification of industrial supply chains. Some of the categories we are excited about are:

Decarbonizing Industrial Sector

Industrial companies such as steel, cement, and chemical manufacturers are some of the largest users of energy. The industrial sector accounts for over a third of global energy use. However, these are quite hard-to-decarbonize sectors (high energy consumers, use a lot of heat, lots of emissions embedded in age-old processes, low margin commodity businesses) with significant pressure and incentive to do so with their emissions being regulated under ETS and the CBAM in Europe. With the amount of land and buildings being used within industrial sectors there is an opportunity to leverage DREs (batteries, solar on roofs, onshore wind) in industrial settings tapping into cheaper and renewable energy when cheapest to consume. This also unlocks the opportunity for industrial companies to contribute to grid flexibility.

Next-gen Electricity Suppliers

Companies such as Tibber, Greenely, and Octopus Energy, have been focused on solving this challenge for the household segment. However, there is an underserved market within B2B energy procurement, and an opportunity to build the next-gen electricity supplier for companies. Subsidies for renewables will be phased out almost entirely across the EU meaning that financing for renewable energy will be driven by corporate and private sector demand. Power Purchasing Agreements (PPAs) linked to renewable energy assets can be the instrument to facilitate this. We believe this can serve as a core driver of grid decarbonization for companies and society.

The next-generation electricity supplier for European businesses will be built on PPAs empowering companies to access electricity at fixed prices, directly from renewable energy sources, maximizing financial stability and driving real decarbonization of the EU grid. Further, being the energy supplier to customers on long-term (5-10 year) contracts unlocks the opportunity to cater to an array of flexibility services to companies and renewable energy developers from grid balancing, energy trading, and both demand and supply side flexibility services (VPPs, demand response, etc.)

Grid Flexibility

Companies that allow the grid to quickly adjust its electricity supply and demand balance in response to variability, unpredictability, and sudden changes in electricity production and consumption to enhance grid resilience. Broadly speaking, grid flexibility startups can be grouped into Frequency Balancing (making immediate adjustments to keep the electricity grid stable) Trading (planning and buying/selling electricity to meet expected future needs), and Flexibility Services (such as VPPs and demand response) that help balance the grid by either quickly adding electricity, storing it, or reducing demand. Many startups will be offering a combination of these services to use cases such as commercial, industrial, or households.

Further, we are excited about the unforeseen opportunities, or the unknown unknowns, of new business models and opportunities that result from the macro shifts of energy generation moving from centralized power plants to the ubiquity of decentralized renewable energy-producing assets that will power the machine that is the European Electricity Grid.

If you are a New Nordic startup building within the opportunity of European energy, whether you are just exploring ideas or have already found your product market fit, we would love to hear from you!